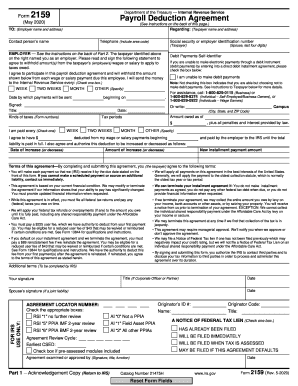

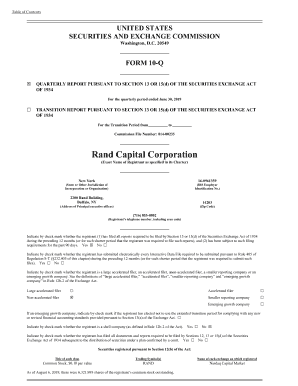

IRS 2159 2024-2025 free printable template

Show details

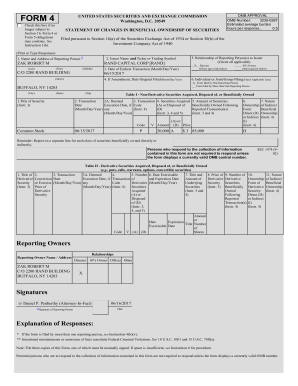

HAS ALREADY BEEN FILED WILL BE FILED IMMEDIATELY Agreement Review Cycle Earliest CSED Check box if pre-assessed modules included WILL BE FILED WHEN TAX IS ASSESSED MAY BE FILED IF THIS AGREEMENT DEFAULTS Agreement examined or approved by Signature title function Part 1 Acknowledgement Copy Return to IRS Catalog Number 21475H Reset Form Fields www.irs.gov Form 2159 Rev. 7-2024 Part 2 Employer s Copy INSTRUCTIONS TO EMPLOYER This payroll deduction agreement is subject to your approval. If you...

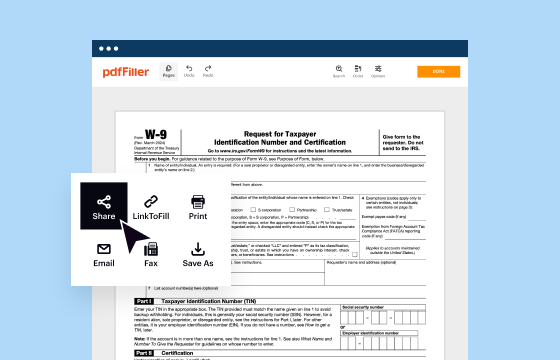

pdfFiller is not affiliated with IRS

How to Navigate and Understand IRS Form 2159

Step-by-step Instructions for Editing Form 2159

Completing the Form: A Practical Guide

How to Navigate and Understand IRS Form 2159

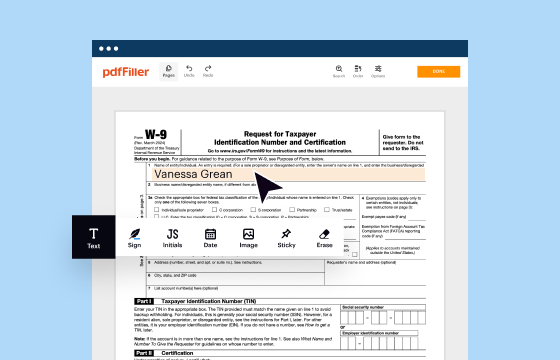

IRS Form 2159, commonly known as the "Application for Voluntary Early Withdrawal," plays a vital role in the management of tax-deferred retirement accounts. Understanding how to properly utilize this form is crucial for individuals seeking to navigate their retirement withdrawals effectively. This guide will provide you with step-by-step instructions and essential insights into Form 2159.

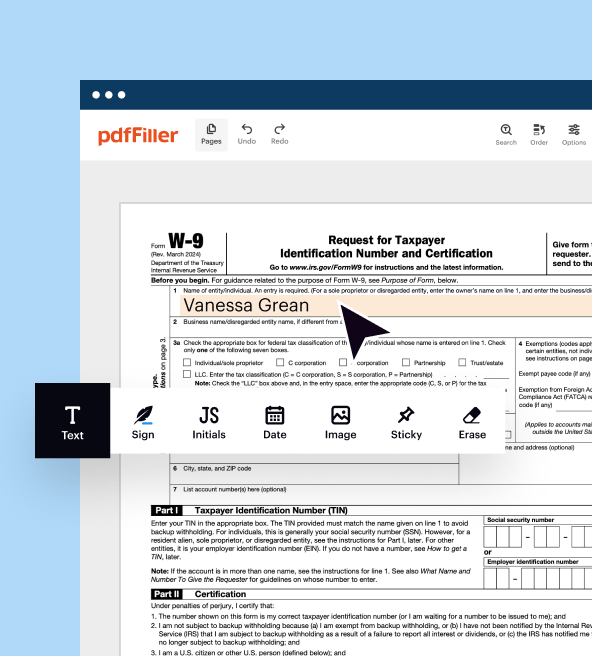

Step-by-step Instructions for Editing Form 2159

Editing IRS Form 2159 involves careful attention to detail and accuracy to ensure compliance. Follow these actionable steps:

01

Review the requirements: Begin by checking if you are eligible to fill out Form 2159 based on your account type and withdrawal reason.

02

Gather necessary information: Collect all personal and financial details needed, including Social Security number, account numbers, and withdrawal amounts.

03

Make necessary changes: Utilize clear fields to update any incorrect information or add any additional details required.

04

Save revisions: Regularly save your progress to avoid losing data, ensuring all edits are captured accurately.

05

Final review: Once edited, carefully proofread the form for completeness and accuracy before submission.

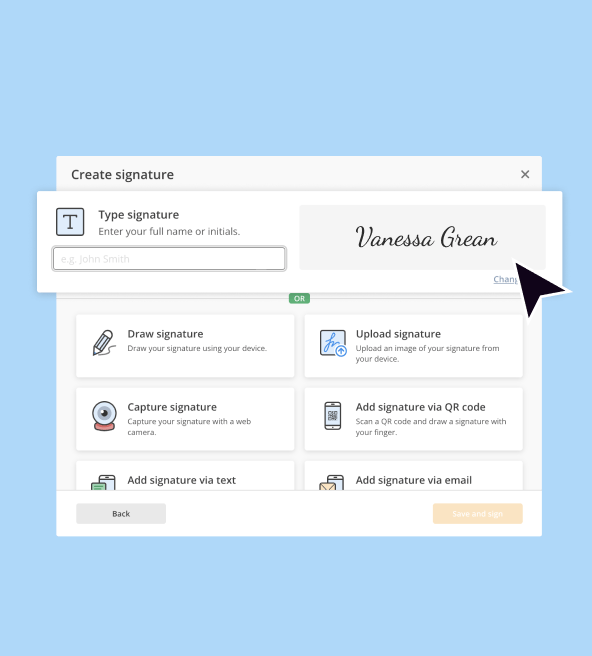

Completing the Form: A Practical Guide

Completing IRS Form 2159 requires attention to several critical sections:

01

Personal Information: Input your full name, address, and Social Security number in the designated areas.

02

Withdrawal Type: Specify the reason for your voluntary early withdrawal, citing relevant account regulations.

03

Financial Details: Provide accurate figures regarding the amount you wish to withdraw and any associated fees.

04

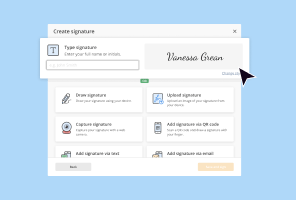

Signature: Ensure you sign and date the form, affirming all provided information is truthful and accurate.

Show more

Show less

Recent Changes and Updates to IRS Form 2159

Recent Changes and Updates to IRS Form 2159

IRS Form 2159 has recently undergone revisions to reflect current tax regulations and to streamline the withdrawal process for applicants. Notable updates include adjusted income thresholds for eligibility and new guidelines to accommodate different account types, such as individual retirement accounts (IRAs) and 401(k) plans. Always verify the latest information on the IRS website before proceeding.

Essential Insights Regarding IRS Form 2159

Understanding IRS Form 2159

The Purpose of IRS Form 2159

Who Needs to Complete This Form?

Criteria for Form Exemptions

Understanding Filing Deadlines for IRS Form 2159

Comparing IRS Form 2159 with Similar Forms

Transactions Covered by IRS Form 2159

Submission Requirements: Number of Copies

Failure to Submit IRS Form 2159: Understanding Penalties

Required Information for Filing IRS Form 2159

Additional Forms Often Submitted with IRS Form 2159

The Correct Submission Address for IRS Form 2159

Essential Insights Regarding IRS Form 2159

Understanding IRS Form 2159

IRS Form 2159 is designed for individuals looking to withdraw early from their retirement accounts. This application is crucial for ensuring that the appropriate tax treatment is applied to these withdrawals, which can significantly impact an individual's financial standing.

The Purpose of IRS Form 2159

The primary purpose of Form 2159 is to document voluntary early withdrawals from retirement accounts while ensuring compliance with IRS regulations. By completing this form, taxpayers can formally request the early disbursement of funds and understand the tax implications associated with it.

Who Needs to Complete This Form?

This form should be completed by individuals seeking to withdraw funds from tax-deferred retirement accounts, including:

01

Account holders facing financial hardship

02

Individuals who have reached a certain age but wish to withdraw before the standard retirement age

03

Participants in employer-sponsored plans looking for early payouts

Criteria for Form Exemptions

Exemptions to the requirements for submitting Form 2159 may apply under specific conditions, such as:

01

Withdrawals made due to qualifying events like disability.

02

Income below a certain threshold that may allow different tax treatments.

03

Specific circumstances in financial hardship withdrawals as defined by IRS guidelines.

Understanding Filing Deadlines for IRS Form 2159

It's essential to meet IRS deadlines to avoid penalties. For early withdrawals, Form 2159 typically must be submitted by April 15 of the tax year in which the withdrawal is made. However, this deadline can vary based on individual circumstances and local tax laws, so always confirm current guidelines.

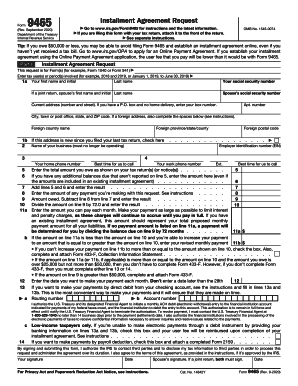

Comparing IRS Form 2159 with Similar Forms

IRS Form 2159 is often compared to Form 5329, which addresses additional taxes on qualified retirement plans, and Form 8606, used for non-deductible IRAs. Unlike Form 2159, these forms focus on reporting taxes due rather than requesting withdrawals.

Transactions Covered by IRS Form 2159

This form typically covers transactions involving early withdrawals from IRAs and 401(k)s, along with special provision exceptions for certain hardships.

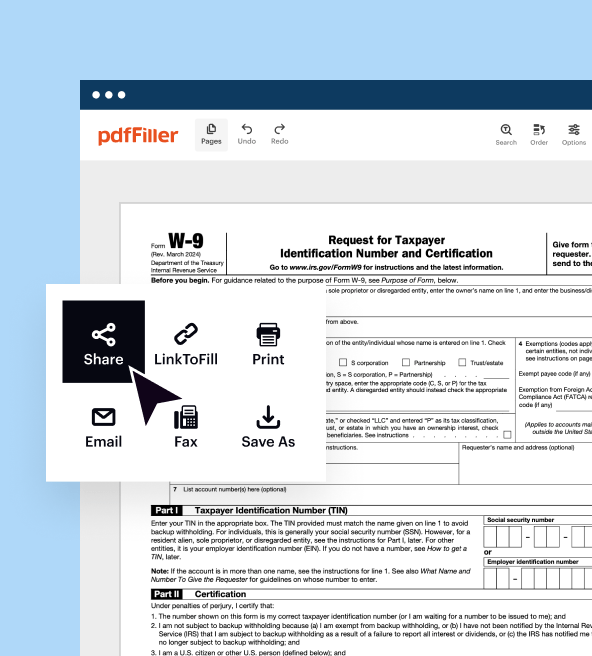

Submission Requirements: Number of Copies

For IRS Form 2159, generally one completed copy is required for submission to the IRS along with any accompanying documentation. However, it's wise to retain copies for your personal records.

Failure to Submit IRS Form 2159: Understanding Penalties

Not filing the IRS Form 2159 can result in serious penalties, including:

01

Financial penalties ranging from 10% to 25% of the withdrawn amount, depending on the withdrawal type.

02

Potential legal implications, leading to audits or additional tax assessments.

Required Information for Filing IRS Form 2159

When filing Form 2159, ensure that you have the following information ready:

01

Your Social Security number

02

Account information related to the withdrawal

03

Details of the withdrawal amount

04

Reason for early withdrawal

Additional Forms Often Submitted with IRS Form 2159

While Form 2159 can be submitted independently, in some cases, you may be required to attach additional documentation or forms, such as Form 5329, for reporting additional tax liabilities.

The Correct Submission Address for IRS Form 2159

Submit your completed IRS Form 2159 to the address indicated in the form instructions. Ensure you are using the correct address for your specific region to avoid processing delays.

By understanding and following these guidelines, you can successfully navigate IRS Form 2159, ensuring that your early withdrawal is processed efficiently and compliantly. If you have further questions or need assistance completing this form, consider reaching out to a tax professional or visiting the IRS website for additional resources.

Show more

Show less

Try Risk Free