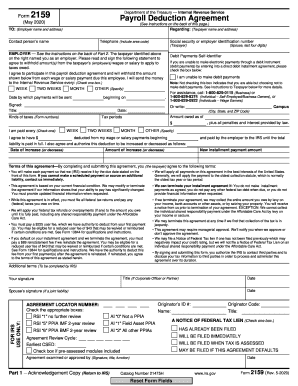

IRS 2159 2024-2026 free printable template

Instructions and Help about IRS 2159

How to edit IRS 2159

How to fill out IRS 2159

Latest updates to IRS 2159

All You Need to Know About IRS 2159

What is IRS 2159?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

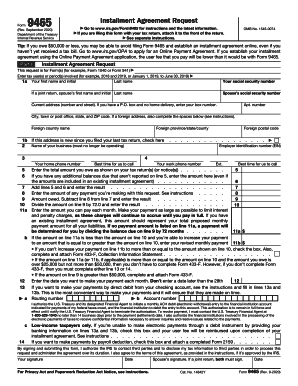

Is the form accompanied by other forms?

FAQ about IRS 2159

What should I do if I need to correct an error on IRS 2159 after submission?

If you need to correct an error on your submitted IRS 2159, you should file an amended form. Ensure you follow the guidelines for corrections, which typically involve identifying the original form and detailing the changes made. This helps the IRS accurately process your corrections and maintain proper records.

How can I verify the status of my IRS 2159 submission?

To verify the status of your IRS 2159 submission, you can use the IRS online tracking tool, which allows you to input your details and check if your form has been received and is in processing. Keep any confirmation numbers handy to facilitate your inquiry.

Are e-signatures accepted when filing IRS 2159?

Yes, e-signatures are generally accepted when filing IRS 2159, depending on the filing method used. Be sure to confirm that your e-signature complies with IRS guidelines, as this helps ensure your form is processed without delay.

What are some common errors that filers encounter with IRS 2159?

Common errors with IRS 2159 include incorrect taxpayer identification numbers, mismatched names, and incomplete information. To avoid these mistakes, review all data carefully before submission and ensure that any supporting documentation aligns with the details provided on the form.

If I receive a letter from the IRS regarding IRS 2159, what steps should I take?

If you receive a letter from the IRS about your IRS 2159 filing, carefully read the correspondence to understand the issues raised. Gather the requested documentation or any evidence needed to address the inquiry, and respond by the deadline indicated in the letter to avoid further penalties.